Stablecoin wallet API for fintech apps

Build fintech on stablecoin rails. Settle globally in seconds. Enterprise security and compliance included. No lock-in.

No credit card required • Free testnet accounts

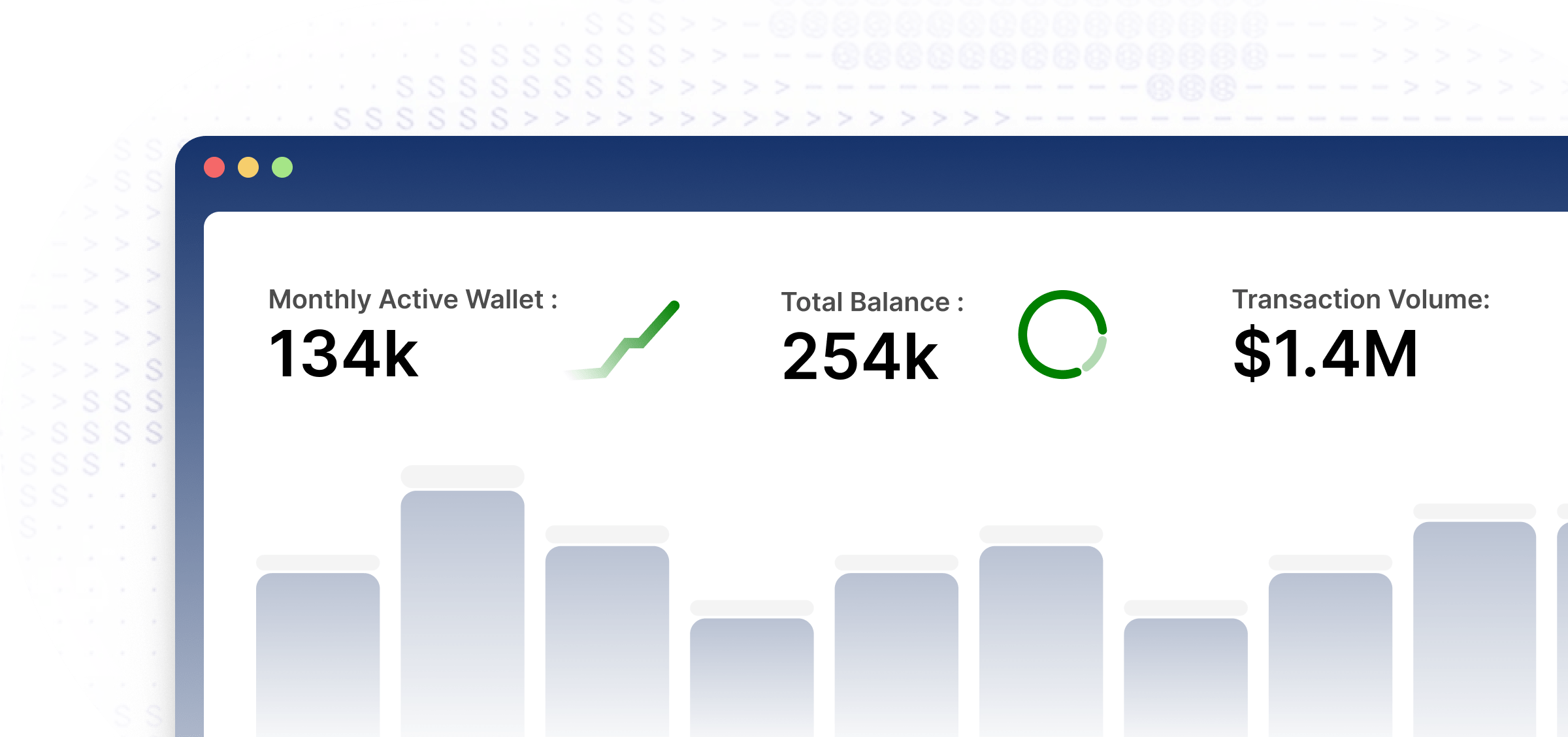

Over 10 million transactions by 50+ customers.

See our customer stories →

Everything you need to launch fast

Stablecoin accounts, global settlement, compliance, and treasury in one platform. Ship in weeks, not years.

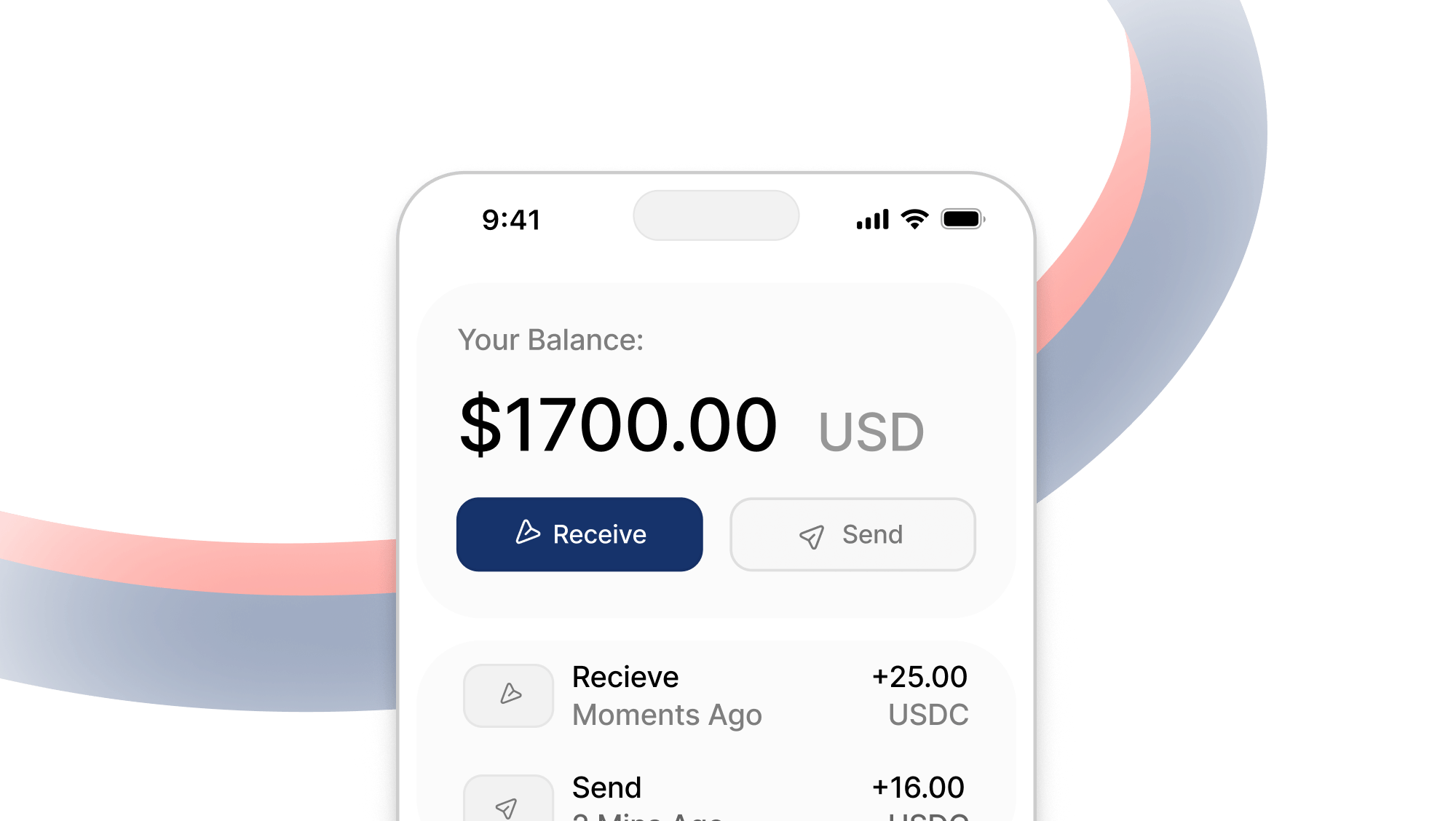

View docsMove money in seconds, not days

Instant cross-border payments at lower cost. Built-in KYC/AML and reporting for 180+ countries.

View docs

Treasury management that scales

Programmable wallets, auto-reconciliation, and real-time liquidity. Works with banks and stablecoin rails.

View APIsTeams save money with Openfort

Reduce your median blockchain transaction cost by up to 40% with Openfort's gas-efficient smart accounts.

Secure by nature

Global coverage

Operate in most regions with stablecoin support.

Enterprise security

Built with GDPR compliance and SOC compliance, and dedicated enterprise support.

Flexible custody

Choose custodial, non-custodial, or hybrid

Frequently Asked Questions

Your question not answered here?

Openfort provides programmable wallets, fiat on-ramps and off-ramps, user authentication, and compliance modules that compose into complete financial flows. These building blocks enable you to create sophisticated fintech products quickly.

Openfort's infrastructure allows you to hold balances globally, transfer across borders with low fees, and pay suppliers or employees quickly via stablecoin rails. This provides instant settlement without traditional banking delays.

Yes, Openfort provides a unified dashboard where you can track users, wallets, and token balances. You can execute transactions using no-code tools and maintain full visibility across your entire operation.

Openfort includes wallet screening for AML compliance, KYC and identity verification, asset review capabilities, and other regulatory controls to help you meet compliance requirements across different jurisdictions.

Users can top up wallets using credit cards or bank accounts through integrated on-ramps, and convert funds back to fiat through off-ramps when needed. This creates seamless bridges between traditional finance and stablecoin infrastructure.